Businesses

Save 21%

On Average With Adapt.

Tired of feeling like your credit card processor is a shady partner trying to drain your bank account? Say goodbye to hidden fees and confusing contracts with Adapt Merchant Services. We keep it real, because who has time for drama when you’re just trying to run a business? We’ll make processing payments smooth for you.

We’re here to make support simple and accessible…

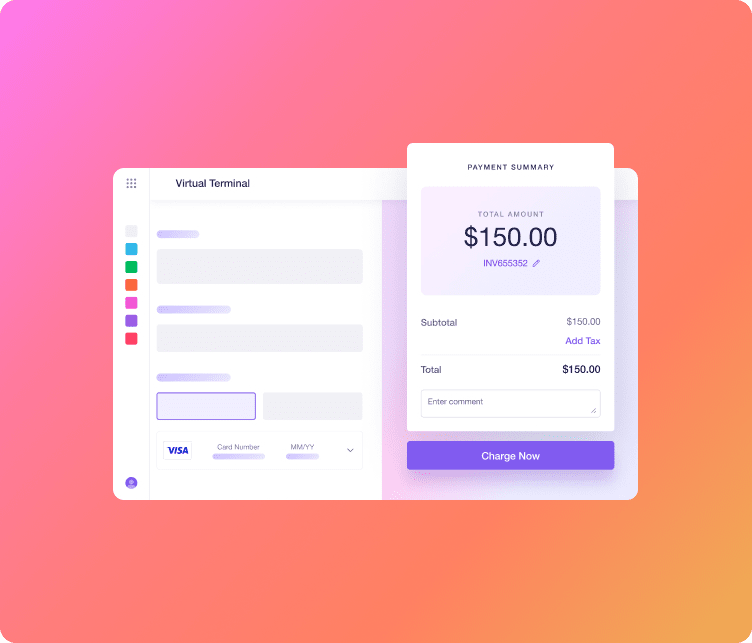

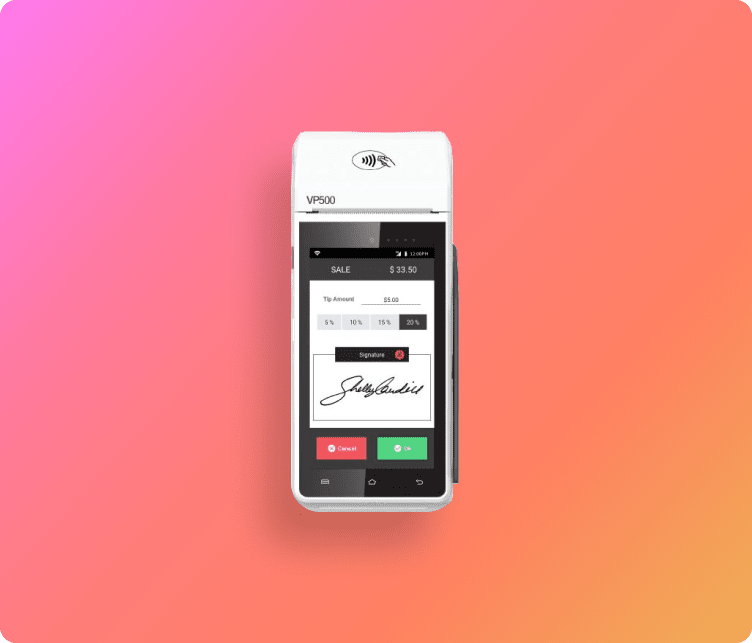

Accept in-person payments.

Accept payments in-person at your business, practice, restaurant, or bar.

Payment solutions for your business.

Tired of hidden fees and sneaky contracts? Our pricing is crystal clear, saving you money without any tricks up our sleeves. We keep your rates low and offer some seriously cool ways to keep those dollars in your pocket. Clear monthly fees or no early termination fees here – just pure savings and smiles!

No Early Termination Fees

No hidden charges

Clear monthly fees

Discover the industries we excel in:

Retail

Restaurant

Healthcare

eCommerce

Gas Stations

Accounting

Non-Profit

Our Hall of Fame: Customers Who've Swiped Their Way to Greatness

FAQ.

Why should I choose Adapt Merchant Services?

Our pricing is crystal clear, saving you money without any tricks up our sleeves. We keep your rates low and offer some seriously cool ways to keep those dollars in your pocket. Clear monthly transparent fees – just pure savings and smiles!

Are there any contracts or hidden fees?

Yes, there is a contract, typically for 36 months. If you don’t fully understand the terms, leaving the contract early could result in additional costs for you as the merchant. We list all our terms on our website, so you’ll always have the information you need.

You might be thinking, “But my processor doesn’t have a contract?” If you’ve signed something, that’s your contract. If you signed up on a website like Square, you might be confusing a traditional processor with an aggregator, which operates under its own terms.

What is the Promise Network?

Promise.Network is a customer portal developed for Adapt Merchant Services clients. It serves as the central hub where merchants can manage their daily, monthly, or yearly financial information, download processing statements, and more. Beyond these essential features, Promise.Network offers a built-in marketplace where merchants can browse and purchase terminals, paper, and other supplies. Additionally, users can manage their end-user gift cards and submit technical support tickets.

From a backend perspective, Promise.Network functions as our customer onboarding tool, handling applications, EULAs, and equipment assets. We are continually enhancing Promise.Network to ensure it remains the best platform for all your processing needs and communication.

How long do funds take to be deposited?

This is a common question! Typically, processors pre-fund your bank account within 24 hours. However, the speed of deposits can vary based on a few factors:

•Bank Type: National banks that also serve as settlement houses (processor backends) generally process deposits faster than smaller banks or credit unions.

•Processing Time: The standard timeframe for deposits is 48 hours. Some processors, including Adapt Merchant Services, offer incentives to expedite this process.

•Batching Transactions: Pay attention to when you batch your transactions. If you batch after midnight, your funds may not appear in your account for at least 24 hours—effectively 36 hours if you operate a 9 am to 5 pm business. Adjusting your batch times can help you receive funds more quickly.

Is there a monthly fee?

Possibly. Most processing accounts have minimum monthly fees to remain active. The specifics can vary, but some costs typically need to be covered.

If you’re reviewing your processing statement and don’t see any monthly fees, consider the following:

•Are you using a traditional processor or an aggregator?

•Is your pricing plan based on a subscription, flat rate, or dual pricing?

There could be several reasons why you don’t see the fees directly. However, it’s likely that your processor has included those costs elsewhere in your pricing.

Start accepting

credit cards today.

Create your free Adapt account now!